Compare the Best Crypto Cards

Choose the ideal crypto card based on your country, perks, cashback, and fees.

Juno Finance Card

Brand: Mastercard

Cashback: Up to ~X% (promo)

Fee: Traditional debit funding model

Countries Accepted: US

Description

Juno Finance & Juno Debit Card – Crypto-Friendly Banking (What You Should Know)

The Juno Debit Card is the payment card offered by Juno Finance — a fintech platform that combined traditional banking-style services with crypto trading and wallet features. The card was meant to let users spend their fiat (USD) balance or crypto-linked funds via a virtual or physical debit card.

✅ Key Features (When Operational)

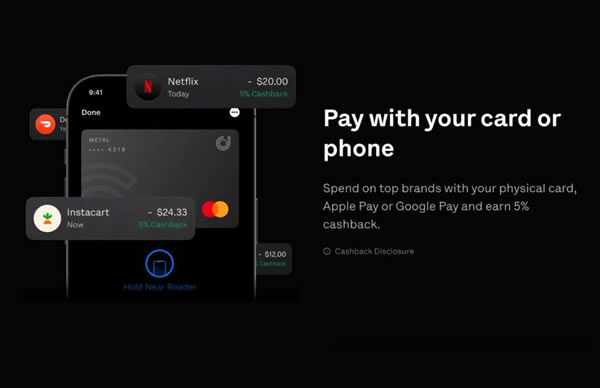

Virtual & Physical Card Options — Upon account funding, users received a virtual debit card compatible with digital wallets (Apple Pay, Google Pay, Samsung Pay). A physical card could also be requested via the Juno dashboard.

Bank-like Checking Account + Crypto Account Integration — Juno combined a “Cash Account” (USD checking) with a “Crypto Account,” allowing you to hold, buy, and sell cryptocurrencies and — at least at one time — spend converted funds via the debit card.

Convenient Transfers and Withdrawals — Traditional banking features like direct deposit, ACH transfers, external bank transfers, ATM withdrawals, and (when supported) no-fee debit card use at certain networks (Allpoint / MoneyPass) were part of the offering.

No Monthly Fees (Initially) — Originally, Juno marketed itself with free checking accounts and no monthly maintenance fees.

Crypto card integrated with checking account; promotional rewards